CBS News Live

CBS News Baltimore: Local News, Weather & More

Watch CBS News

Like Baltimore City's lawsuit against the two Singapore-based companies, the company claims the owners of the Dali were negligent in letting the ship leave the Port of Baltimore without failing to fix known power problems.

A former high school athletic director was arrested Thursday morning after allegedly using artificial intelligence to impersonate the school principal in a recording that included racist and antisemitic comments.

FROST ADVISORY in effect for parts of the area this morning. Warmer weather returns later this weekend.

Follow live updates as former President Donald Trump's criminal trial continues in New York.

Jackson Holliday has been optioned to Triple A-Norfolk just shy of a month into the 2024 season, the Orioles announced today.

Ships stuck in the Port of Baltimore since the collapse of the Francis Scott Key Bridge last month are finally departing Thursday.

Opioid addictions often start by having access to prescription medications.

The Baltimore Ravens selected cornerback Nate Wiggins from Clemson with the 30th overall pick on Thursday in the first round of the 2024 NFL Draft.

The Francis Scott Key Bridge crumbled on March 26 after its support column was struck by a malfunctioning cargo ship.

Meteorologist Meg McNamara has your Friday morning forecast 4/26/2024

Like Baltimore City's lawsuit against the two Singapore-based companies, the company claims the owners of the Dali were negligent in letting the ship leave the Port of Baltimore without failing to fix known power problems.

Ships stuck in the Port of Baltimore since the collapse of the Francis Scott Key Bridge last month are finally departing Thursday.

A fourth temporary channel is scheduled to open at the Port of Baltimore on Thursday, according to the U.S. Coast Guard Captain of the Port.

The Baltimore Ravens selected cornerback Nate Wiggins from Clemson with the 30th overall pick on Thursday in the first round of the 2024 NFL Draft.

Jayden Daniels was not sure the Washington Commanders would call his name, after months of questions about which quarterback they wanted. He's glad they did.

It's a decision that has been widely projected as a virtual lock for this NFL Draft, especially after the Bears traded away Justin Fields to the Steelers.

The three-day NFL Draft starts on Thursday, and several local draft hopefuls could have their lifelong dreams come true.

The Baltimore Ravens will attempt to bolster their roster this week with new rookies from the NFL Draft.

Enjoying the warm weather in Maryland's outdoors? The DNR has some good ideas for you

The weekend-long events include an opening ceremony, live cooking competitions and an awards ceremony at Marriott Baltimore Waterfront.

UMD is celebrating Maryland Day with a slew of events

MPT airs 30 programs through Chesapeake Bay Week a

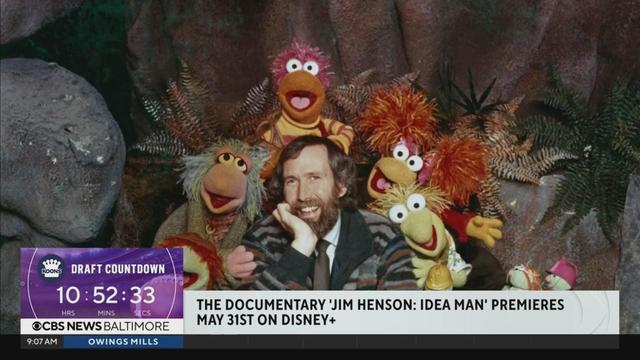

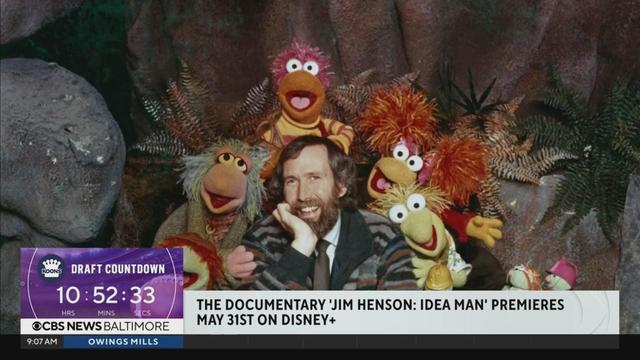

Jim Henson was born and raised in Mississippi but moved with his family to Maryland when he was 10 years old. He went to the University of Maryland where he met his wife and partner, Jane, in a puppetry class.

The conference delivers opportunities for aspiring enterprisers to connect with seasoned entrepreneurs, interact with exhibitors, and attend education sessions.

Flowers by Chris joins WJZ to talk about business and tips on planting and gardening this spring

Where's Marty? Learning about X-Laser in Howard County.

The event features live performances from local gospel artists

Small Miracles Cat and Dog Rescue in Ellicott City is a rescue that also operates as its own shelter!

Enjoying the warm weather in Maryland's outdoors? The DNR has some good ideas for you

Sydney's ice cream is located at 3432 Belair Road.

The weekend-long events include an opening ceremony, live cooking competitions and an awards ceremony at Marriott Baltimore Waterfront.

Today we're back with Sydney Newton who has opened her first brick-and-mortar store in the Belair Edison neighborhood

Like Baltimore City's lawsuit against the two Singapore-based companies, the company claims the owners of the Dali were negligent in letting the ship leave the Port of Baltimore without failing to fix known power problems.

A former high school athletic director was arrested Thursday morning after allegedly using artificial intelligence to impersonate the school principal in a recording that included racist and antisemitic comments.

FROST ADVISORY in effect for parts of the area this morning. Warmer weather returns later this weekend.

Follow live updates as former President Donald Trump's criminal trial continues in New York.

Jackson Holliday has been optioned to Triple A-Norfolk just shy of a month into the 2024 season, the Orioles announced today.

Like Baltimore City's lawsuit against the two Singapore-based companies, the company claims the owners of the Dali were negligent in letting the ship leave the Port of Baltimore without failing to fix known power problems.

Opioid addictions often start by having access to prescription medications.

Ships stuck in the Port of Baltimore since the collapse of the Francis Scott Key Bridge last month are finally departing Thursday.

Rapper Busta Rhymes and funk rockers Morris Day and The Time are headlining the 47th annual AFRAM this year in Baltimore.

A former high school athletic director was arrested Thursday morning after allegedly using artificial intelligence to impersonate the school principal in a recording that included racist and antisemitic comments.

Enjoying the warm weather in Maryland's outdoors? The DNR has some good ideas for you

The weekend-long events include an opening ceremony, live cooking competitions and an awards ceremony at Marriott Baltimore Waterfront.

UMD is celebrating Maryland Day with a slew of events

MPT airs 30 programs through Chesapeake Bay Week a

Jim Henson was born and raised in Mississippi but moved with his family to Maryland when he was 10 years old. He went to the University of Maryland where he met his wife and partner, Jane, in a puppetry class.

The Baltimore Ravens selected cornerback Nate Wiggins from Clemson with the 30th overall pick on Thursday in the first round of the 2024 NFL Draft.

Jayden Daniels was not sure the Washington Commanders would call his name, after months of questions about which quarterback they wanted. He's glad they did.

It's a decision that has been widely projected as a virtual lock for this NFL Draft, especially after the Bears traded away Justin Fields to the Steelers.

The three-day NFL Draft starts on Thursday, and several local draft hopefuls could have their lifelong dreams come true.

The Baltimore Ravens will attempt to bolster their roster this week with new rookies from the NFL Draft.

Follow live updates as former President Donald Trump's criminal trial continues in New York.

Former National Enquirer boss David Pecker appeared on the stand for the third day, detailing an agreement the tabloid made with a former Playboy model.

The Supreme Court convened to consider whether former President Donald Trump is entitled to broad immunity from criminal charges in the 2020 election case.

Jurors in former President Donald Trump's trial in New York heard testimony from a former media executive about his efforts to bury negative stories about Trump before the 2016 presidential election.

Jurors in former President Donald Trump's criminal trial in New York got their first glimpse of the arguments both sides plan to make.

When it comes to vintage style, art and innovation—Baltimore is home to it all.

The University of Maryland Medical Center was granted the American Nurses Credentialing Center's (ANCC) Magnet for the fourth time in a row.

Magali Uroza comes from a Mexican immigrant family and remembers the challenges of learning English while growing up in Baltimore.

It is the cherry trees' second-earliest peak bloom on record and follows one of Washington's warmest recorded winters. In 1990, the trees blossomed on March 15.

Georgia rapper Offset surprised students at Dunbar High School on Tuesday for their stellar academic performance and attendance according to the Baltimore Police Department.

The Maryland Food Bank is on pace to distribute more than 52 million pounds of food, which is a 20 percent jump in comparison to pre-COVID times.

It has long been a popular resource in the community, easily accessible to many college students and neighbors.

Has mom and dad's bank been open too long at your house?

According to a report from the National Institute on Retirement Security, 40% of Gen Xers have zero dollars saved for retirement.

According to Bankrate, Baltimore is one of the top 10 most affordable cities for buying used cars.

Primanti Bros. on Tuesday announced plans to expand to the Baltimore region this spring.

CVS is closing dozens of pharmacies inside Target stores in 2024 as the store and other retail pharmacy chains face increasing difficulties.

The wildly popular chicken finger joint opened its doors Tuesday at the Snowden River Shopping Center.

The council passed the "Bring Your Own Bag Act" with a bipartisan vote in February.

Baltimore is one of 31 designees announced Monday, picked from nearly 400 applicants.

Opioid addictions often start by having access to prescription medications.

Regular screenings are critical to identifying and treating cancer early. It's also important to be aware of any genetic mutations that already exist in your body.

Health officials are warning consumers not to consume Infinite Herbs basil sold at some Trader Joe's and Dierberg's stores after 12 people were sickened.

Most worrisome gaps involve cancer chemotherapy drugs, ER medications and and therapies for ADHD.

The prepackaged boxes of deli meat, cheese and crackers are not a healthy choice for kids, advocacy group says.

Rapper Busta Rhymes and funk rockers Morris Day and The Time are headlining the 47th annual AFRAM this year in Baltimore.

The significance of the song was amplified by praise from music legend Paul McCartney, who called the recording "magnificent" and appreciated its reinforcement of the civil rights message he intended when writing "Blackbird."

Charli XCX and Troye Sivan are stopping in Baltimore this fall on a joint tour.

In the 1,000th episode, titled "A Thousand Yards," NCIS comes under attack by a mysterious enemy from the past.

A Billy Joel special on CBS and Paramount+ will air again after it was cut off in the middle of the singer's performance of "Piano Man."

Meteorologist Meg McNamara has your Friday morning forecast 4/26/2024

Warmer weather returns later this weekend.

Derek Beasley has your Thursday night forecast (4/25/2024)

Derek Beasley has your Thursday evening forecast (4/25/2024)

Derek Beasley has your Thursday evening forecast (4/25/2024)

Small Miracles Cat and Dog Rescue in Ellicott City is a rescue that also operates as its own shelter!

Enjoying the warm weather in Maryland's outdoors? The DNR has some good ideas for you

Sydney's ice cream is located at 3432 Belair Road.

The weekend-long events include an opening ceremony, live cooking competitions and an awards ceremony at Marriott Baltimore Waterfront.

Today we're back with Sydney Newton who has opened her first brick-and-mortar store in the Belair Edison neighborhood